The Cone of Uncertainty during Market Turmoil

Philip Kim CFP®, ChFC®, CLU®, RICP®, CRES

Managing Director

(3 minute read)

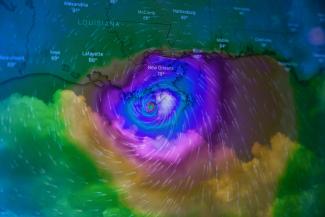

Every summer, areas south of Florida and the Keys make the headlines during a period of time that we refer to as “Hurricane Season.” When an especially intimidating storm develops in the Gulf and threatens to make landfall in the Caribbean or even in the Southeastern U.S., some of us might watch the news in anticipation of potential calamity.

The National Hurricane Center issues a predictive path of this developing storm called the “cone of uncertainty.” The cone maps out the likely track of the eye, or center, of the hurricane. Based on this projection, people who reside in those areas can plan to either ride out the storm or evacuate entirely. So, in terms of functionality, the purpose of the “cone of uncertainty” is to provide advance warning as well as to allow for preemptive safety measures for local inhabitants.

The “cone of uncertainty” is only a prediction, and the National Hurricane Center expects the storm to remain in this path 60 to 70% of the time based on the Center’s accuracy over the past five years.¹ In finance, we refer to this as “standard deviation,” that is, a statistical number that predicts the likelihood of a market outcome.

Financial planning, when using a goals-based approach, may include modeling a version of this “cone of uncertainty” in order to prepare for cyclical downturns. By using a blend of investment strategies and integrating a diversified approach², one might be able to develop a statistical likelihood for a predicted outcome.

This type of probability estimate is called a Monte Carlo³ simulation. Borrowed from the gambling world, a Monte Carlo simulation produces a confidence metric based on 1000 iterations of an expected outcome. And, just like a “cone of uncertainty” might provide a 60 to 70% forecasted path, a Monte Carlo simulation provides a percentage-based probability that a particular scenario might unfold in the future.

What these statistical projections boil down to, whether we are talking about hurricanes or financial planning, is developing a plan to help reduce uncertainties and minimize risk. In the case of an impending hurricane, residents might build houses with specialized reinforcements and a minimum clearance above ground level. In the case of financial planning, firms like ours build an investment strategy designed to reduce the impact of market fluctuations.

A flaw with both the “cone of uncertainty” as well as a Monte Carlo simulation is that neither one represents the magnitude of risk. They are simply predictors of the occurrence of a risk. The reality is that if a storm should strike, the magnitude and impact of the event can be a frightening experience. In financial planning, being able to manage one’s emotions during these types of seismic events, no matter how unsettling, is fundamental to increasing the likelihood of success.

For meteorologists, utilizing the “cone of uncertainty” model is important because it allows them to communicate potential risk to the population. And in financial planning, using projection models can be beneficial because it produces a predictive path that a household can use to prepare for their financial future.

-

Diversification positions assets among major investment categories, based on an individual client’s level of risk to potentially lower the risk of the entire portfolio, however it does not guarantee a profit or protection against a loss.

-

While a Monte Carlo simulation can illustrate the range of probabilities associated with achieving personal financial goals for a chosen set of assets, the projections or other information contained in the Monte Carlo report do not state or guarantee that a particular outcome has occurred or will occur.